Work

Hi, I’m Abhinav Kanukuntla.

Turning ideas into interfaces you actually want to use.

Scroll to see work

2020-2025

Mar 2024

Nov 2020

Long-Term

The Portfolio targets medium to long-term growth by investing in global leaders in sectors like AI, EVs, and Renewables.

Performance

Investments

Rebalances

Managed by

Facts

Performance vs Benchmarks

INR

USD

Our Strategy (Global Leaders)

6.12%

4.93%

3.10%

S&P 500

NIFTY 50

1M

YTD

1Y

3Y

Inception

Buy Recommendations

Potential Upside

+75%

Varun Beverages Limited

Closing price of ₹1808.9 on 20 May 2025

Allocation

23%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

Potential Upside

+75%

Amazon.co Inc

Closing price of ₹1808.9 on 20 May 2025

Allocation

19%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

View all

Metrics

P/E Ratio

Portfolio

2.38%

Nifty500

1.8%

-10%

10%

higher the better

ROCE (%)

Portfolio

-2.38%

Nifty500

1.8%

-10%

10%

higher the better

Price/Book Ratio

Portfolio

1.5

Nifty500

0.9

-20%

15%

lower the better

Current Ratio

Portfolio

1.8

Nifty500

1.2

+5%

10%

higher the better

Net Profit Margin (%)

Portfolio

5.0%

Nifty500

4.0%

+15%

20%

higher the better

Sector Split of this Strategy

Sectors

Sector Wise Break-up

Technology

53%

Healthcare

11%

Consumer Discretionary

25%

View Split

Recent Calls

Stable assets are low-volatility investments that provide steady returns.

MAR 2023

Exit

HDFC Bank Ltd

Portfolio Profit

+24%

MAR 2023

Buy

HDFC Bank Ltd

Upside

+24%

JAN 2024

HDFC Bank Something Ltd

Allocation

-24%

JAN 2024

HDFC Bank Something Ltd

- 2%

View all

Managed by

Ketul Sakhpara

25+ years experience

registered

Ketul Sakhpara, CFA is the Founder of BayFort Capital with over 20 years of experience. Read More

Niranjan

10+ years experience

registered

₹150 Cr

AUM

HDFC Bank Limited is a prominent private bank in India, offering a wide range. Read More

Why Invest in global leaders?

Global Growth

Invest in high-growth sectors like AI, EV, Biotech, and Robotics through a focused global portfolio not available in traditional domestic funds.

Innovation Driven

Gain access to innovation-driven global stocks aligned with themes like “Data is the New Oil,” offering opportunities beyond local markets.

Expert Review & Rebalancing

Every basket is reviewed by investment experts and rebalanced periodically to stay aligned with market shifts and investor goals.

Transparent & Trackable

Each basket is SEBI-compliant, performance-tracked, and easy to monitor from your dashboard.

Portfolio Facts

Lock-in Period

None

Annual Management Fee

2.5% (Incl. GST)

Min. Initial Investment

₹ 10 Lacs

Min. Additional Investment

₹ 85,000

Market Cap. Restriction

Above $10 Billion

Get Your

AI-Powered Portfolio

Get Portfolio

13:13

Custom Strategies

stack wealth / 2025

Built an AI-powered system that delivers personalized investment strategies based on individual preferences and goals, while driving higher product engagement and improving user session flow.

your investments

43.12%

YTD

₹19,01,215.4

3M

6M

1Y

3Y

5Y

ALL

MAR 2024

Your Stacks

+8

₹ 19,20,210

Vault

+3

₹ 19,20,210

8 Funds underperforming

SIP center

Get Ultimate Power of SIP with Stack

₹15,000/m invested for 10 years

₹24.2L

12%

BENCHMARK

₹32.2L

17.2%

STACK WEALTH

aggressive portfolio with returns of 12.5%

Start an SIP

Trending categories

Best for SIP

Beat the markets with our smart portfolios powered by quant.

3y cagr upto

24.6%

Explore

Flexicap Kings

Beat the markets with our smart portfolios powered by quant.

3y cagr

24.6%

High ranking funds

Funds with NIFTY Beating Returns.

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Top Rated

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

Explore all

explore mutual funds

All Mutual Fund Categories

Best in SIP

Upto 24.6%

Index Investing

Upto 24.6%

Index Investing

24.6%

₹

₹

Fixed Income

Upto 24.6%

Best in SIP

Upto 24.6%

Best in SIP

24.6%

Explore All Funds

have questions?

Your Dedicated Wealth Team

certified

₹150 Cr

AUM

Schedule a Call

Investing can be rewarding.

Stack Wealth

13:13

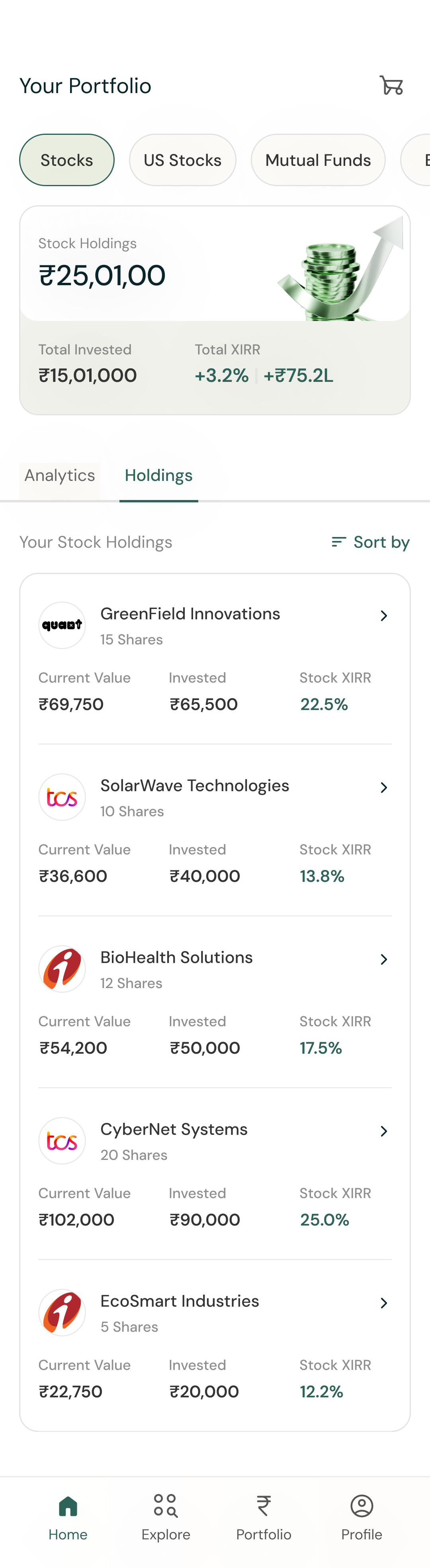

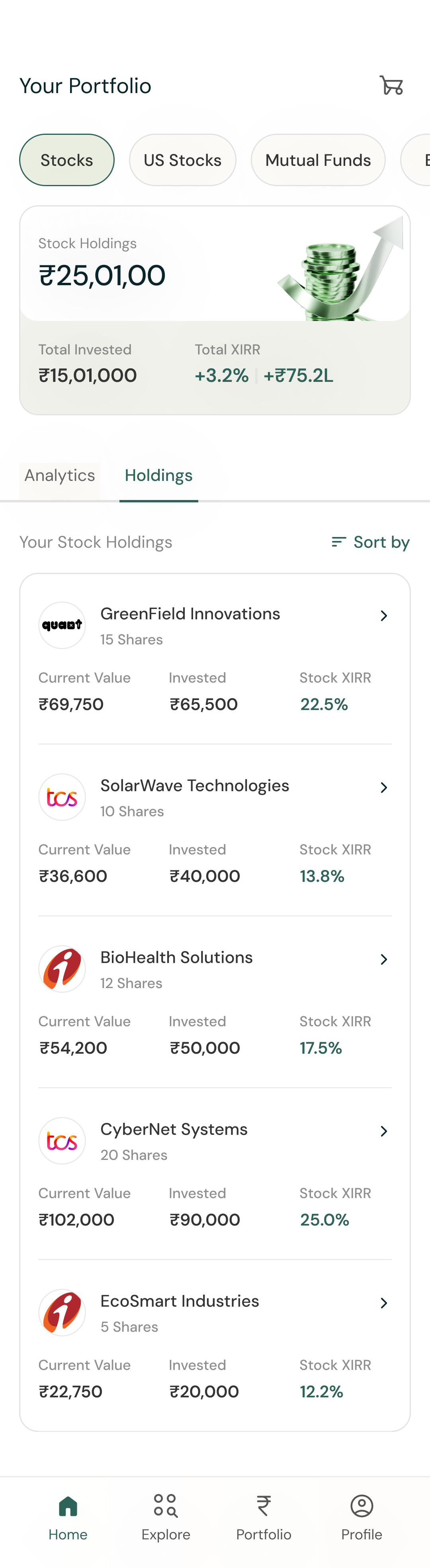

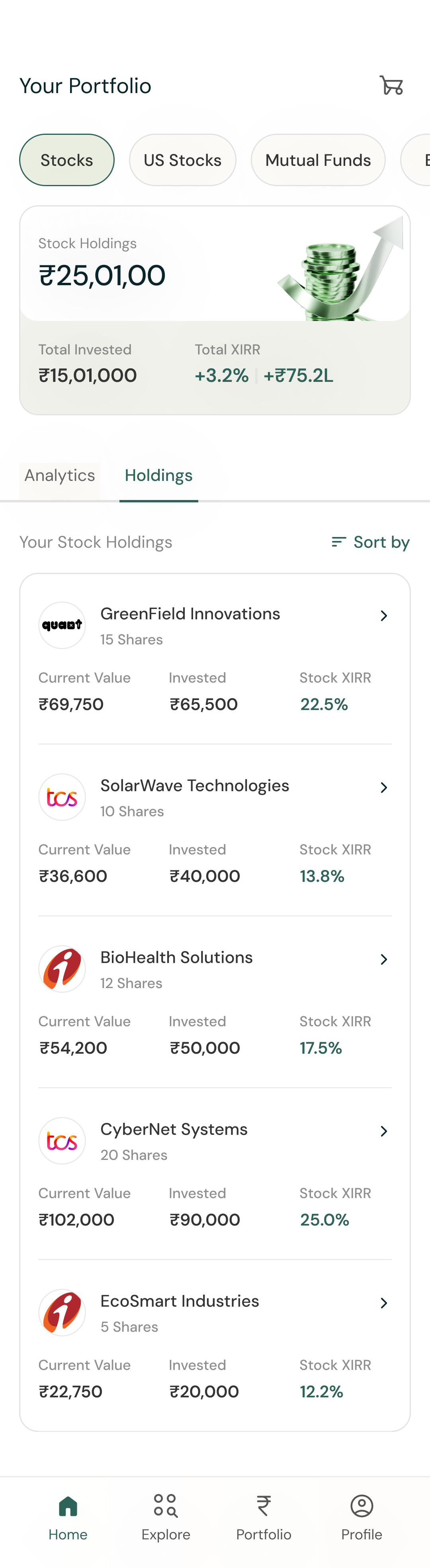

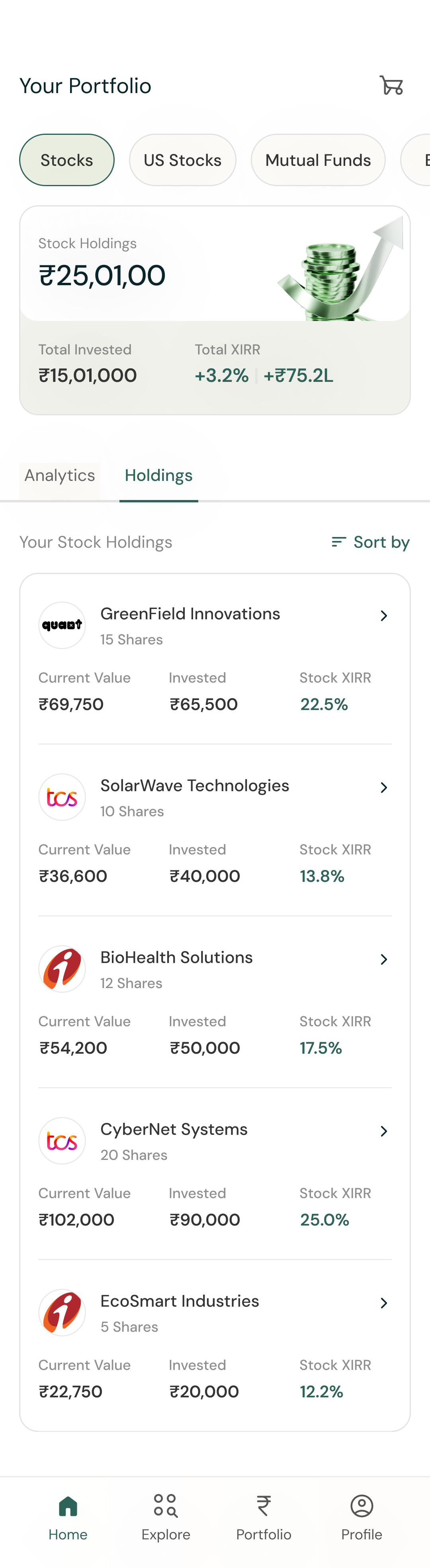

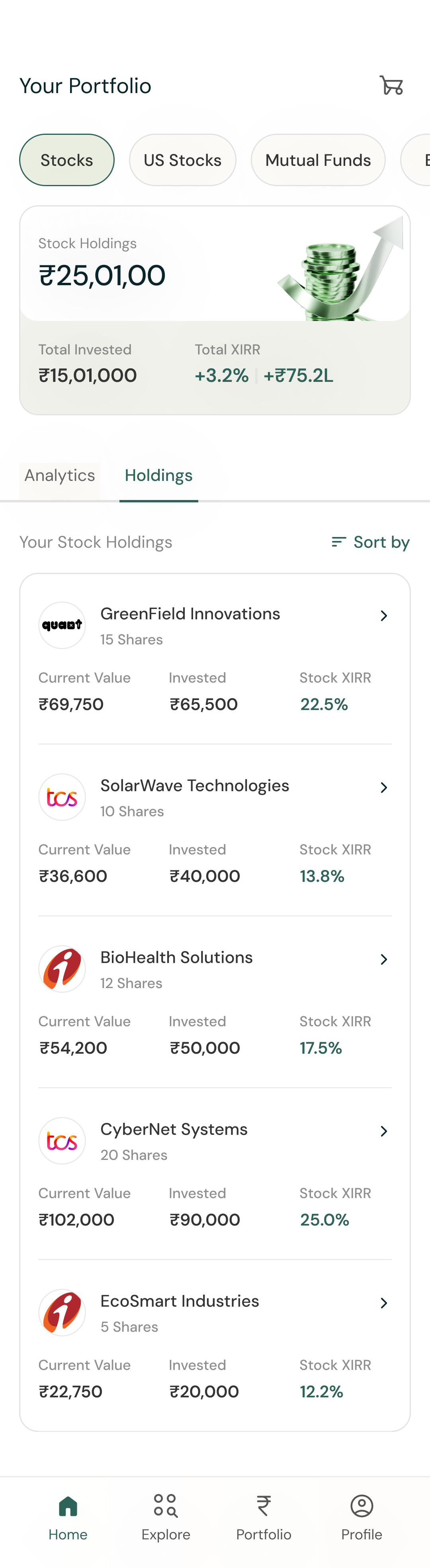

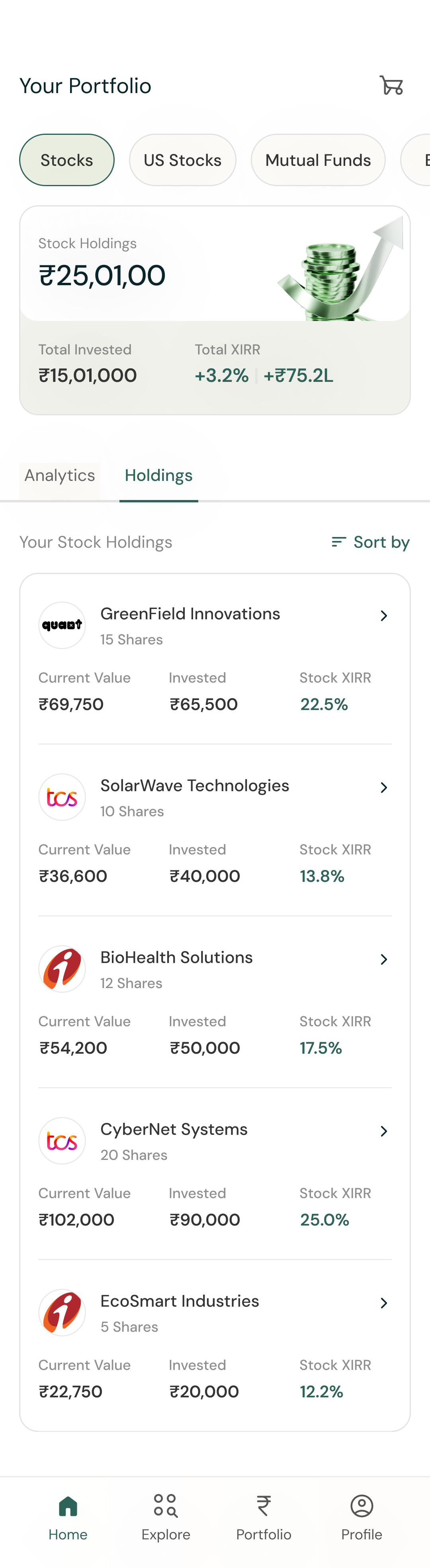

Portfolio Analytics

stack wealth / 2023

Built end-to-end analytics for mutual fund portfolios, transforming raw, cluttered data into clear visual insights that reveal what users are missing, reduce noise, and deliver tangible value.

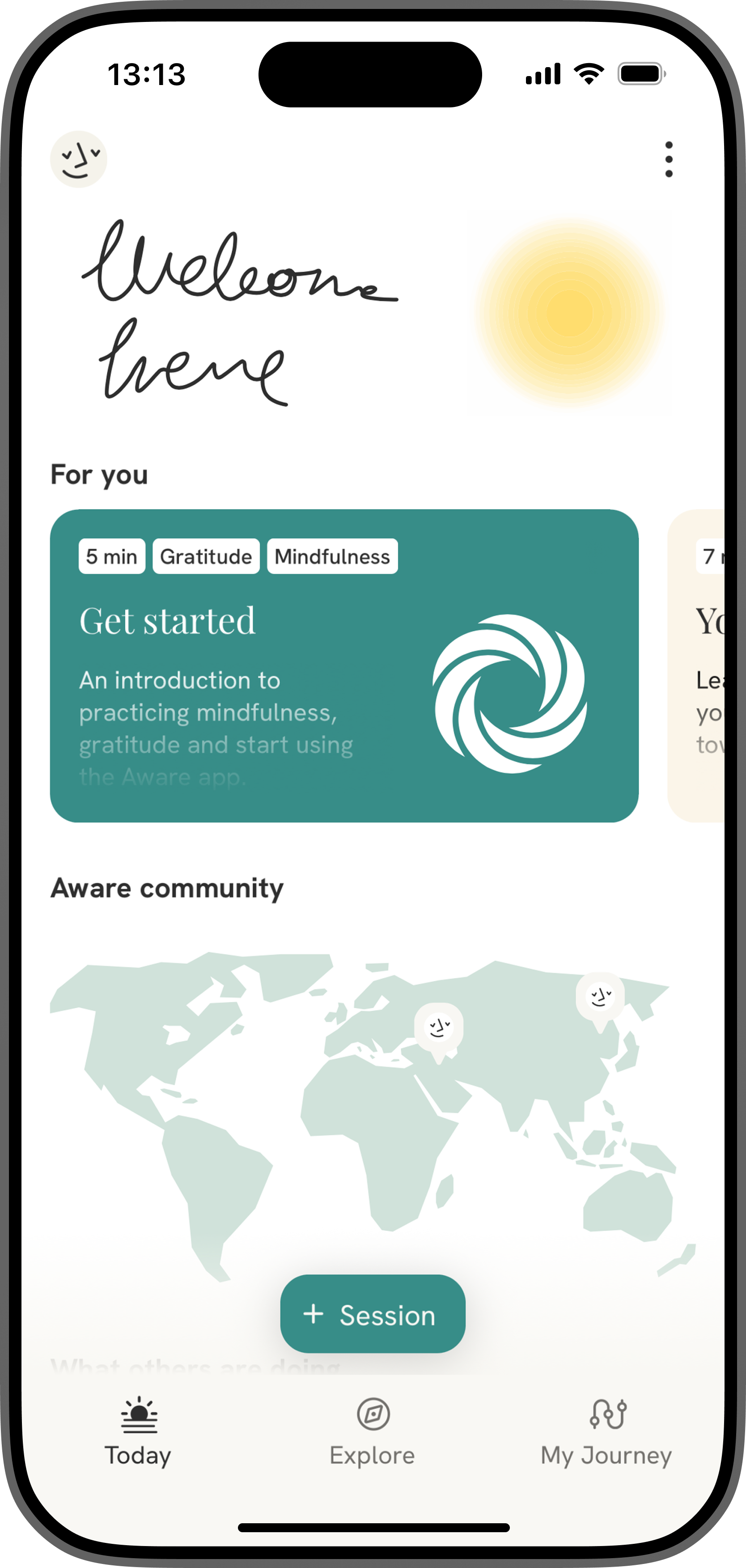

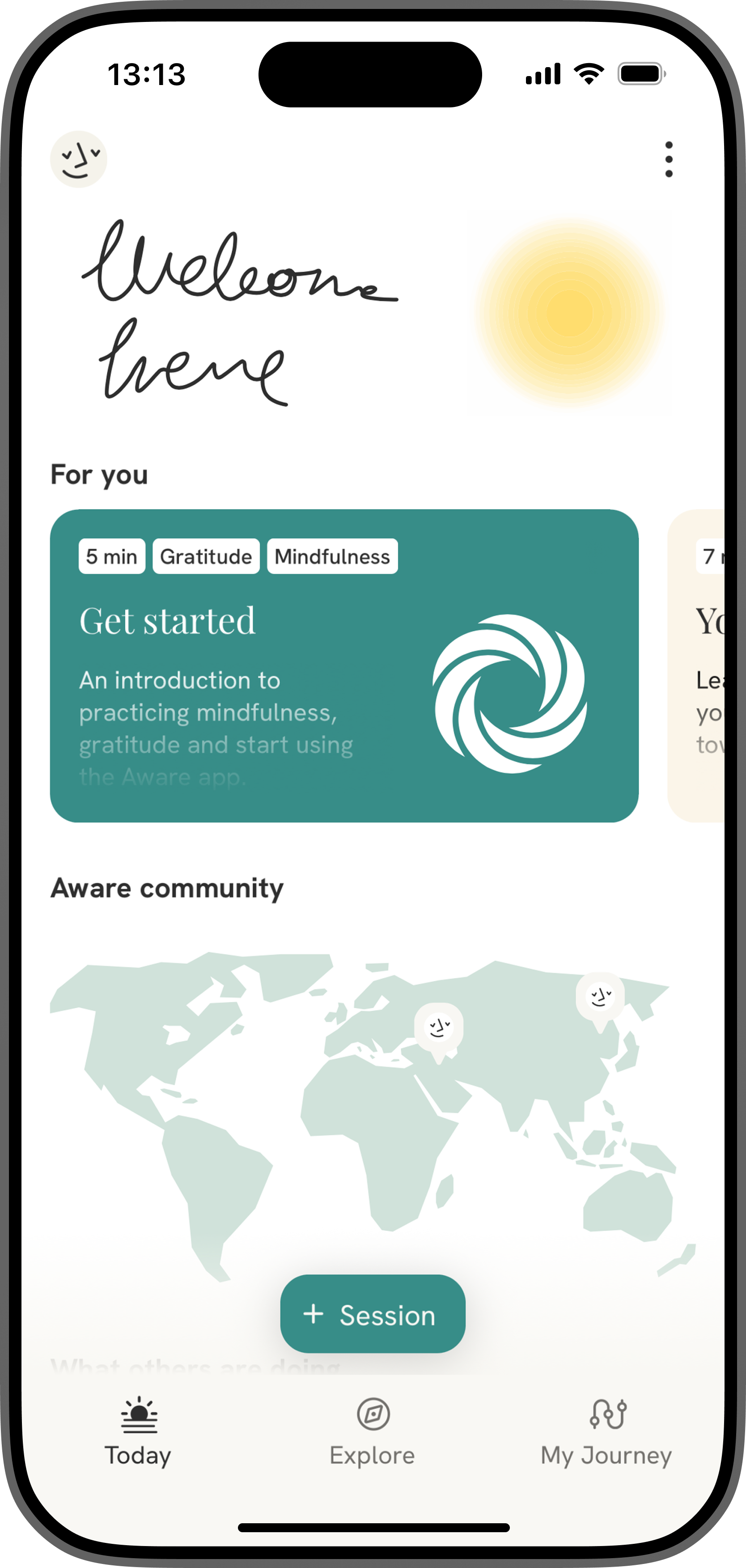

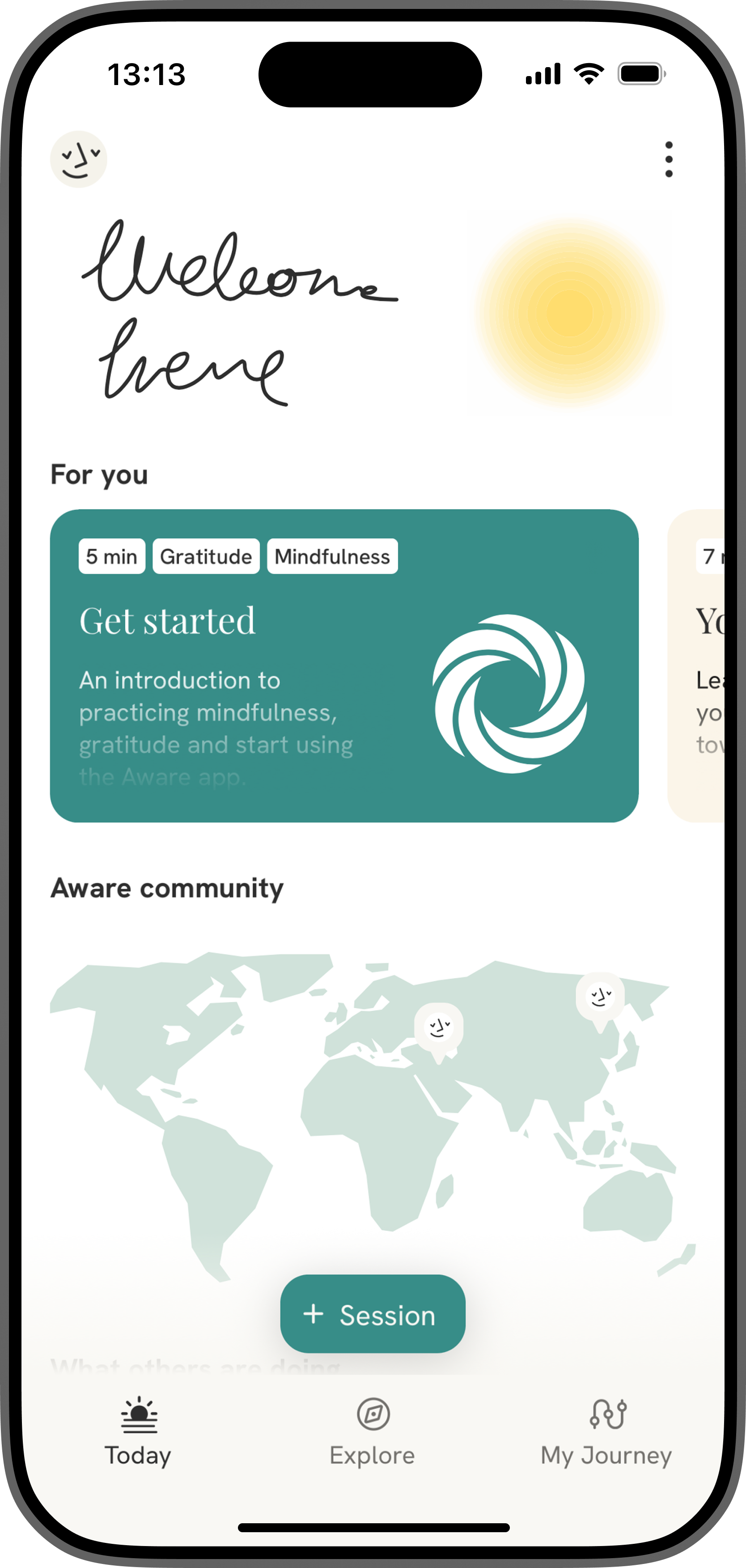

Session Experience

29k aware/ 2023

Enhance user interaction within the session screens of the Aware app, making inner development sessions more engaging and personal

More projects coming soon — stay tuned!

Work

Hi, I’m Abhinav Kanukuntla.

Turning ideas into interfaces you actually want to use.

Scroll to see work

2020-2025

Long-Term

The Portfolio targets medium to long-term growth by investing in global leaders in sectors like AI, EVs, and Renewables.

Performance

Investments

Rebalances

Managed by

Facts

Performance vs Benchmarks

INR

USD

Our Strategy (Global Leaders)

6.12%

4.93%

3.10%

S&P 500

NIFTY 50

1M

YTD

1Y

3Y

Inception

Buy Recommendations

Potential Upside

+75%

Varun Beverages Limited

Closing price of ₹1808.9 on 20 May 2025

Allocation

23%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

Potential Upside

+75%

Amazon.co Inc

Closing price of ₹1808.9 on 20 May 2025

Allocation

19%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

View all

Metrics

P/E Ratio

Portfolio

2.38%

Nifty500

1.8%

-10%

10%

higher the better

ROCE (%)

Portfolio

-2.38%

Nifty500

1.8%

-10%

10%

higher the better

Price/Book Ratio

Portfolio

1.5

Nifty500

0.9

-20%

15%

lower the better

Current Ratio

Portfolio

1.8

Nifty500

1.2

+5%

10%

higher the better

Net Profit Margin (%)

Portfolio

5.0%

Nifty500

4.0%

+15%

20%

higher the better

Sector Split of this Strategy

Sectors

Sector Wise Break-up

Technology

53%

Healthcare

11%

Consumer Discretionary

25%

View Split

Recent Calls

Stable assets are low-volatility investments that provide steady returns.

MAR 2023

Exit

HDFC Bank Ltd

Portfolio Profit

+24%

MAR 2023

Buy

HDFC Bank Ltd

Upside

+24%

JAN 2024

HDFC Bank Something Ltd

Allocation

-24%

JAN 2024

HDFC Bank Something Ltd

- 2%

View all

Managed by

Ketul Sakhpara

25+ years experience

registered

Ketul Sakhpara, CFA is the Founder of BayFort Capital with over 20 years of experience. Read More

Niranjan

10+ years experience

registered

₹150 Cr

AUM

HDFC Bank Limited is a prominent private bank in India, offering a wide range. Read More

Why Invest in global leaders?

Global Growth

Invest in high-growth sectors like AI, EV, Biotech, and Robotics through a focused global portfolio not available in traditional domestic funds.

Innovation Driven

Gain access to innovation-driven global stocks aligned with themes like “Data is the New Oil,” offering opportunities beyond local markets.

Expert Review & Rebalancing

Every basket is reviewed by investment experts and rebalanced periodically to stay aligned with market shifts and investor goals.

Transparent & Trackable

Each basket is SEBI-compliant, performance-tracked, and easy to monitor from your dashboard.

Portfolio Facts

Lock-in Period

None

Annual Management Fee

2.5% (Incl. GST)

Min. Initial Investment

₹ 10 Lacs

Min. Additional Investment

₹ 85,000

Market Cap. Restriction

Above $10 Billion

Get Your

AI-Powered Portfolio

Get Portfolio

13:13

Nov 2020

Mar 2024

Custom Strategies

stack wealth / 2025

Built an AI-powered system that delivers personalized investment strategies based on individual preferences and goals, while driving higher product engagement and improving user session flow.

your investments

43.12%

YTD

₹19,01,215.4

3M

6M

1Y

3Y

5Y

ALL

MAR 2024

Your Stacks

+8

₹ 19,20,210

Vault

+3

₹ 19,20,210

8 Funds underperforming

SIP center

Get Ultimate Power of SIP with Stack

₹15,000/m invested for 10 years

₹24.2L

12%

BENCHMARK

₹32.2L

17.2%

STACK WEALTH

aggressive portfolio with returns of 12.5%

Start an SIP

Trending categories

Best for SIP

Beat the markets with our smart portfolios powered by quant.

3y cagr upto

24.6%

Explore

Flexicap Kings

Beat the markets with our smart portfolios powered by quant.

3y cagr

24.6%

High ranking funds

Funds with NIFTY Beating Returns.

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Top Rated

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

Explore all

explore mutual funds

All Mutual Fund Categories

Best in SIP

Upto 24.6%

Index Investing

Upto 24.6%

Index Investing

24.6%

₹

₹

Fixed Income

Upto 24.6%

Best in SIP

Upto 24.6%

Best in SIP

24.6%

Explore All Funds

have questions?

Your Dedicated Wealth Team

certified

₹150 Cr

AUM

Schedule a Call

Investing can be rewarding.

Stack Wealth

13:13

Portfolio Analytics

stack wealth / 2023

Built end-to-end analytics for mutual fund portfolios, transforming raw, cluttered data into clear visual insights that reveal what users are missing, reduce noise, and deliver tangible value.

Session Experience

29K aware / 2023

Enhance user interaction within the session screens of the Aware app, making inner development sessions more engaging and personal

More projects coming soon — stay tuned!

Work

Hi, I’m Abhinav Kanukuntla.

Turning ideas into interfaces you actually want to use.

Scroll to see work

2020-2025

Long-Term

The Portfolio targets medium to long-term growth by investing in global leaders in sectors like AI, EVs, and Renewables.

Performance

Investments

Rebalances

Managed by

Facts

Performance vs Benchmarks

INR

USD

Our Strategy (Global Leaders)

6.12%

4.93%

3.10%

S&P 500

NIFTY 50

1M

YTD

1Y

3Y

Inception

Buy Recommendations

Potential Upside

+75%

Varun Beverages Limited

Closing price of ₹1808.9 on 20 May 2025

Allocation

23%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

Potential Upside

+75%

Amazon.co Inc

Closing price of ₹1808.9 on 20 May 2025

Allocation

19%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

View all

Metrics

P/E Ratio

Portfolio

2.38%

Nifty500

1.8%

-10%

10%

higher the better

ROCE (%)

Portfolio

-2.38%

Nifty500

1.8%

-10%

10%

higher the better

Price/Book Ratio

Portfolio

1.5

Nifty500

0.9

-20%

15%

lower the better

Current Ratio

Portfolio

1.8

Nifty500

1.2

+5%

10%

higher the better

Net Profit Margin (%)

Portfolio

5.0%

Nifty500

4.0%

+15%

20%

higher the better

Sector Split of this Strategy

Sectors

Sector Wise Break-up

Technology

53%

Healthcare

11%

Consumer Discretionary

25%

View Split

Recent Calls

Stable assets are low-volatility investments that provide steady returns.

MAR 2023

Exit

HDFC Bank Ltd

Portfolio Profit

+24%

MAR 2023

Buy

HDFC Bank Ltd

Upside

+24%

JAN 2024

HDFC Bank Something Ltd

Allocation

-24%

JAN 2024

HDFC Bank Something Ltd

- 2%

View all

Managed by

Ketul Sakhpara

25+ years experience

registered

Ketul Sakhpara, CFA is the Founder of BayFort Capital with over 20 years of experience. Read More

Niranjan

10+ years experience

registered

₹150 Cr

AUM

HDFC Bank Limited is a prominent private bank in India, offering a wide range. Read More

Why Invest in global leaders?

Global Growth

Invest in high-growth sectors like AI, EV, Biotech, and Robotics through a focused global portfolio not available in traditional domestic funds.

Innovation Driven

Gain access to innovation-driven global stocks aligned with themes like “Data is the New Oil,” offering opportunities beyond local markets.

Expert Review & Rebalancing

Every basket is reviewed by investment experts and rebalanced periodically to stay aligned with market shifts and investor goals.

Transparent & Trackable

Each basket is SEBI-compliant, performance-tracked, and easy to monitor from your dashboard.

Portfolio Facts

Lock-in Period

None

Annual Management Fee

2.5% (Incl. GST)

Min. Initial Investment

₹ 10 Lacs

Min. Additional Investment

₹ 85,000

Market Cap. Restriction

Above $10 Billion

Get Your

AI-Powered Portfolio

Get Portfolio

13:13

Nov 2020

Mar 2024

Custom Strategies

stack wealth / 2025

Built an AI-powered system that delivers personalized investment strategies based on individual preferences and goals, while driving higher product engagement and improving user session flow.

your investments

43.12%

YTD

₹19,01,215.4

3M

6M

1Y

3Y

5Y

ALL

MAR 2024

Your Stacks

+8

₹ 19,20,210

Vault

+3

₹ 19,20,210

8 Funds underperforming

SIP center

Get Ultimate Power of SIP with Stack

₹15,000/m invested for 10 years

₹24.2L

12%

BENCHMARK

₹32.2L

17.2%

STACK WEALTH

aggressive portfolio with returns of 12.5%

Start an SIP

Trending categories

Best for SIP

Beat the markets with our smart portfolios powered by quant.

3y cagr upto

24.6%

Explore

Flexicap Kings

Beat the markets with our smart portfolios powered by quant.

3y cagr

24.6%

High ranking funds

Funds with NIFTY Beating Returns.

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Top Rated

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

Explore all

explore mutual funds

All Mutual Fund Categories

Best in SIP

Upto 24.6%

Index Investing

Upto 24.6%

Index Investing

24.6%

₹

₹

Fixed Income

Upto 24.6%

Best in SIP

Upto 24.6%

Best in SIP

24.6%

Explore All Funds

have questions?

Your Dedicated Wealth Team

certified

₹150 Cr

AUM

Schedule a Call

Investing can be rewarding.

Stack Wealth

13:13

Portfolio Analytics

stack wealth / 2023

Built end-to-end analytics for mutual fund portfolios, transforming raw, cluttered data into clear visual insights that reveal what users are missing, reduce noise, and deliver tangible value.

Session Experience

29K aware / 2023

Enhance user interaction within the session screens of the Aware app, making inner development sessions more engaging and personal

More projects coming soon — stay tuned!